VPN Wisdom: Your Guide to Online Privacy

Explore the world of VPNs and enhance your online security.

Insurance Showdown: Who Really Has Your Back?

Uncover the truth in insurance! Discover which providers genuinely protect you in our ultimate showdown. Don't get left in the dark!

Top 5 Insurance Myths Debunked: What You Need to Know

When it comes to insurance, numerous myths can cloud people's understanding and lead to costly mistakes. For instance, many believe that insurance is too expensive for their needs. However, affordable options are available, especially if consumers shop around and compare policies. Another pervasive myth is that credit scores do not impact insurance premiums. In reality, insurers often use credit information to gauge risk, which can affect your rates significantly. Learning the truth behind these and other misconceptions is crucial for making informed financial decisions.

Additionally, some people assume that all insurance policies are essentially the same, leading them to overlook the importance of understanding policy details. In fact, the coverage and terms can vary greatly between providers. Furthermore, many believe filing a claim will automatically result in higher premiums. While this can sometimes be the case, not all claims affect rate increases, and it is essential to weigh the benefits of filing a claim against potential premium hikes. Debunking these myths empowers individuals to navigate their insurance needs more effectively.

Understanding Your Coverage: Are You Really Protected?

When it comes to understanding your insurance coverage, it's crucial to assess whether you are genuinely protected in the event of an unforeseen incident. Many policyholders only skim through their policies, often missing key details that could affect their financial security. Understanding your coverage involves more than just knowing the basics; it requires a thorough examination of the terms, exclusions, and limits of your policy. For more in-depth insights, consider reviewing resources like Nolo's Insurance Coverage Basics.

Additionally, it's wise to regularly revisit and update your policy to adapt to any changes in your circumstances or assets. For example, if you've recently acquired expensive items or made significant renovations to your home, these changes should be reflected in your coverage. Always remember that are you really protected? This question can be answered by consulting with an insurance agent to ensure your coverage aligns with your current needs. Useful information can be found at Consumer Reports' Insurance Guide for better understanding and comparison of different policies.

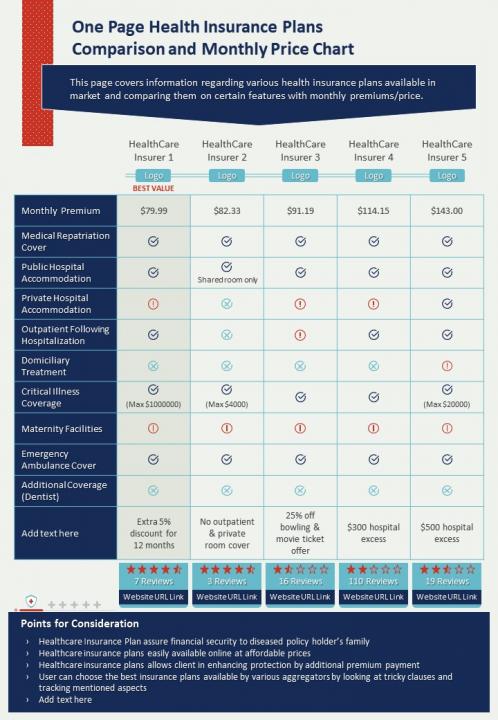

Insurance Plans Compared: Which One Truly Has Your Back?

When it comes to choosing an insurance plan, the options can be overwhelming. Insurance plans vary significantly in coverage, cost, and provider networks. To make an informed decision, consider key factors such as premiums, deductibles, copayments, and out-of-pocket maximums. For instance, a plan with a lower premium may seem attractive, but if it comes with high deductibles and limited coverage, it could end up costing you more in the long run. Healthcare.gov provides detailed insights on how to analyze these elements effectively.

It’s essential to compare not just the numbers, but also the overall benefits that each plan offers. Some insurance plans may include additional perks like wellness programs, telehealth services, or mental health support that provide added value. To find a plan that truly has your back, evaluate the list of covered services, provider accessibility, and customer service ratings. Resources like Consumer Reports can help you access comprehensive reviews and comparisons of various insurance plans, ensuring you choose the right coverage for your specific needs.