VPN Wisdom: Your Guide to Online Privacy

Explore the world of VPNs and enhance your online security.

KYC Verification and Withdrawals: A Necessary Dance in the Digital Age

Unlock the secrets of KYC verification and withdrawals in the digital age. Discover why this crucial dance keeps your finances safe!

Understanding the Importance of KYC Verification in Digital Transactions

KYC (Know Your Customer) verification is a critical process in the realm of digital transactions, particularly in the financial and cryptocurrency sectors. It involves collecting and verifying personal information from customers to ensure that they are who they claim to be. This practice is vital for several reasons, including fraud prevention and compliance with regulatory standards. By implementing KYC protocols, businesses can mitigate risks associated with identity theft and money laundering, fostering a safer environment for all participants in digital marketplaces.

Moreover, KYC verification enhances trust between service providers and customers. When users know that a platform is conducting thorough identity checks, they are more likely to engage in transactions confidently. In addition, KYC compliance can lead to improved customer relationships and greater long-term loyalty. As digital transactions continue to rise, understanding and prioritizing the importance of KYC will not only protect businesses but also empower consumers to engage safely in an increasingly digital economy.

To take advantage of exclusive offers, be sure to check out the rainbet promo code and boost your gaming experience.

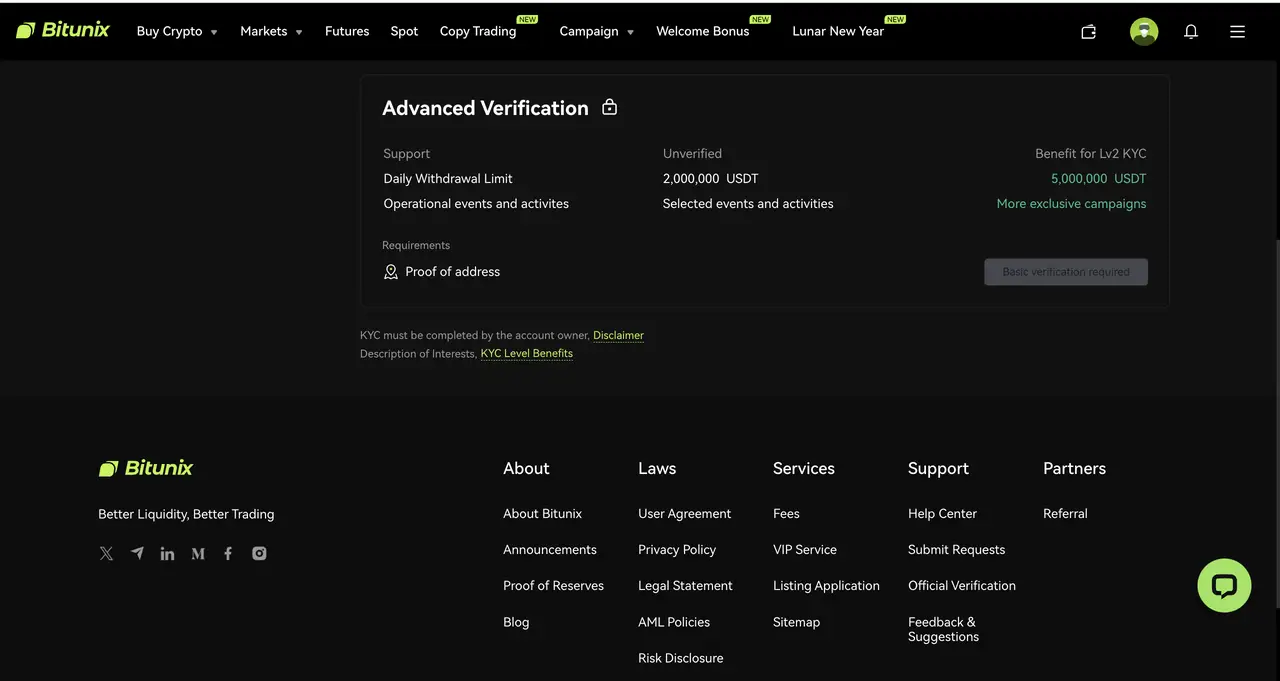

Navigating the Withdrawal Process: Your Guide to Safe and Secure Transactions

Navigating the withdrawal process can often seem daunting, but with the right knowledge, it can be a seamless experience. Safe and secure transactions are essential for ensuring that your funds are transferred without any issues. Begin by ensuring that you have all the necessary documentation and that your financial institution is trustworthy. Always verify the withdrawal limits and fees associated with your transactions to avoid unexpected surprises. Remember, understanding the withdrawal process is crucial for protecting your assets and ensuring peace of mind.

Once you have a clear understanding of the requirements, it's time to initiate your withdrawal. Follow these steps for a smooth transaction:

- Log into your account: Make sure you are accessing your account through a secure network.

- Select the withdrawal option: Find the appropriate section for withdrawals and choose the desired amount.

- Confirm your transaction: Review all details and confirm your request.

What Are the Common Challenges in KYC Verification and How Can You Overcome Them?

Know Your Customer (KYC) verification is crucial for financial institutions and businesses to comply with regulations and prevent fraud. However, there are several common challenges faced during the KYC process. One major issue is the inconsistency of customer documents. Customers may provide identification that is outdated or does not match the information on file, leading to confusion and delays. Additionally, the process can be time-consuming, with lengthy manual checks required for each customer's documentation. In many cases, businesses also grapple with the integration of technology into their existing systems, making it hard to streamline KYC processes effectively.

To overcome these challenges, businesses can adopt a multi-faceted approach. Implementing automated KYC solutions can significantly reduce the time and effort involved in document verification. Such tools utilize advanced technologies like artificial intelligence and machine learning to verify ids rapidly and accurately, thus minimizing human error. Moreover, establishing clear communication with customers regarding the required documentation can ensure that they provide accurate information upfront, reducing inconsistencies. Regular training for staff on the latest compliance norms and technologies can further enhance the KYC process and help mitigate common pitfalls.